Table Of Content

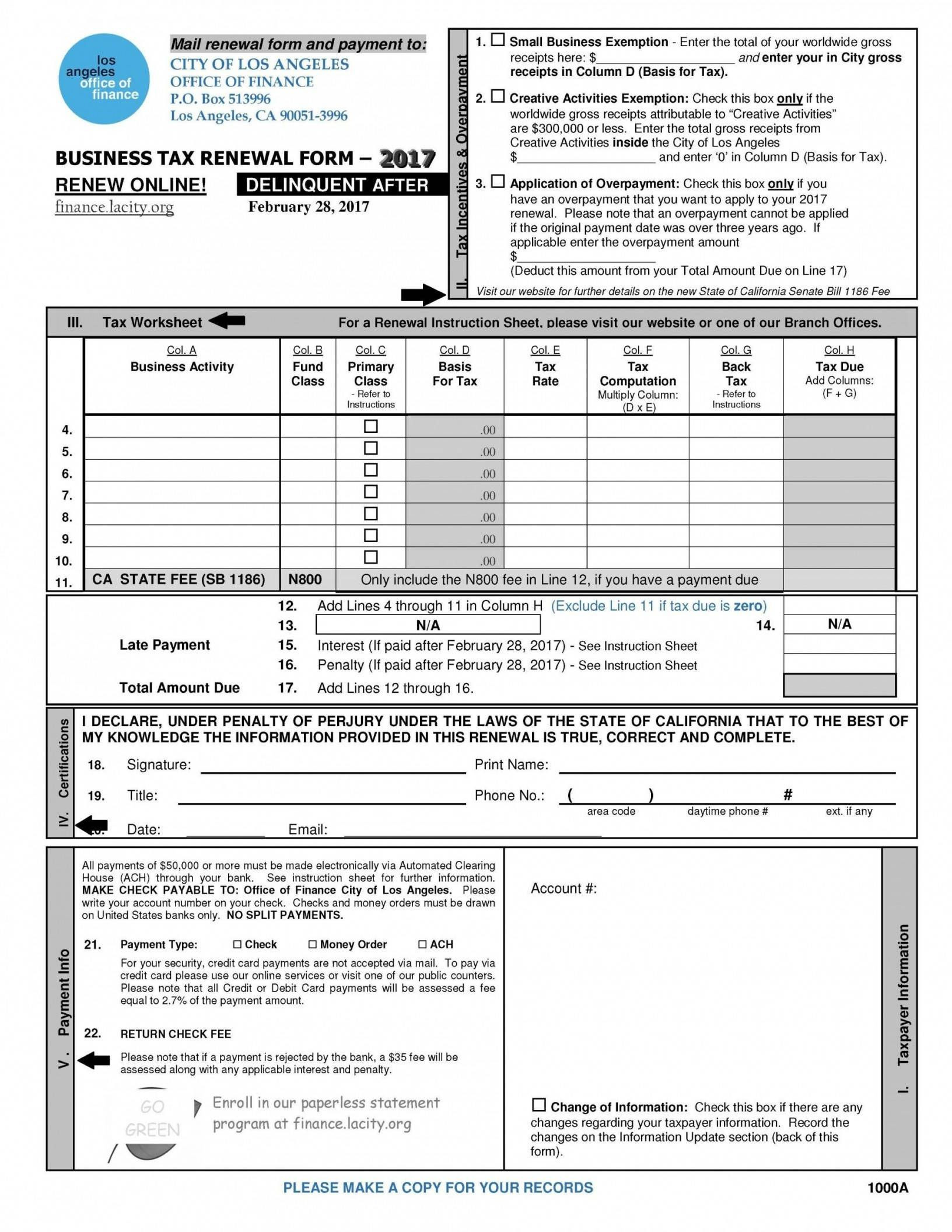

As always, when it comes to tax policy, the devil is in the details. Investors and businesses should take a measured approach, seeking professional advice to navigate the potential changes ahead (Welcome to Mondaq). There is no tax deduction for transfer taxes, stamp taxes, or other taxes, fees, and charges you paid when you sold your home. However, if you paid these amounts as the seller, you can treat these taxes and fees as selling expenses. If you pay these amounts as the buyer, include them in your cost basis of the property. If the buyer is making payments to you over time (as when you provide seller financing), then you must generally report part of each payment as interest on your tax return.

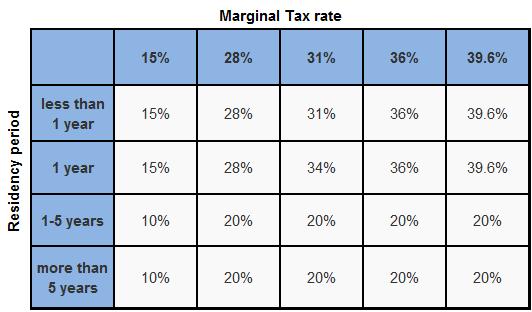

Capital gains tax rates

If you have a difference in the treatment of federal and state capital gains, file California Capital Gain or Loss Schedule D (540). The IRS is committed to serving taxpayers with limited-English proficiency (LEP) by offering OPI services. The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers (TACs), most IRS offices, and every VITA/TCE tax return site. You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. If you have questions about a tax issue; need help preparing your tax return; or want to download free publications, forms, or instructions, go to IRS.gov to find resources that can help you right away. Depending on your circumstances, you may need to figure your real estate tax deductions differently.

Tax Deductions on Rental Properties

Jackie and Pat are considered to have paid a proportionate share of the real estate taxes on the home even though they didn’t actually pay them to the taxing authority. If you qualify for an exclusion on your home sale, up to $250,000 ($500,000 if married and filing jointly) of your gain will be tax free. If your gain is more than that amount, or if you qualify only for a partial exclusion, then some of your gain may be taxable. This section contains step-by-step instructions for figuring out how much of your gain is taxable.

How to report capital gains or losses on your tax return

In fact, you may be able to take advantage of capital gains exemptions to avoid this expense altogether. There's no limit to the number of times you can claim the exclusion. If you don't satisfy the holding period requirement and sell the stock for less than the purchase price, your loss is a capital loss but you still may have ordinary income. You have 180 days from selling your real estate to invest the proceeds in a QOF. You can invest all of your short- or long-term capital gain proceeds from the sale or just part of the gains.

I'm a 42-year-old father with a $210,000 investment property. Can I leave it to my daughter without triggering a large ... - Yahoo Finance

I'm a 42-year-old father with a $210,000 investment property. Can I leave it to my daughter without triggering a large ....

Posted: Wed, 21 Feb 2024 08:00:00 GMT [source]

Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Zacks may license the Zacks Mutual Fund rating provided herein to third parties, including but not limited to the issuer. You can even wait and re-purchase the assets you sold at a loss if you want them back, but you'll still get a tax write-off if you time it right. Some robo-advisor firms have found ways to automate this process by frequently selling investments at a loss and then immediately buying a very similar asset. This allows you to stay invested in the market while still taking advantage of the tax deductions from your losses.

An owner’s principal residence is the real estate used as the primary location in which they live. But what if the home you are selling is an investment property, rather than your principal residence? An investment or rental property is real estate purchased or repurposed to generate income or a profit for the owner(s) or investor(s). As a married couple filing jointly, they were able to exclude $500,000 of the capital gains, leaving $200,000 subject to capital gains tax. The Taxpayer Relief Act of 1997 significantly changed the implications of home sales in a beneficial way for homeowners. Before the act, sellers had to roll the full value of a home sale into another home within two years to avoid paying capital gains tax.

You have a capital loss if you sell the asset for less than your adjusted basis. Losses from the sale of personal-use property, such as your home or car, aren't tax deductible. The amount you pay in capital gains tax can vary and depends on your income, tax filing status, the amount of time that you’ve owned your property and whether the house is your primary residence. The amount you end up with as a profit after selling your property is the capital gain that will be taxed. If your mom passes on the home to you, you'll automatically get a stepped-up basis equal to the market value of $300,000.

How to Lower Capital Gains Taxes With Tax-Loss Harvesting

High-dollar tax issues, like real estate capital gains, are closely watched by the IRS, so it's not only important to seek advice to make sure you maximize your tax breaks, but to make sure you're doing it correctly. As a final point, it's important to emphasize that there is no way we can cover every potential real estate sale situation in this article, and there's admittedly some gray area in the tax code. For example, maybe you made a certain repair/improvement during your ownership and you aren't sure whether it should be added to the property's cost basis. When you sell an asset for more than it cost you to acquire it, the difference is known as a capital gain.

Examples of Improvements That Increase Basis

A single-family home, a condominium, a cooperative apartment, a mobile home, and a houseboat each may be a main home and therefore qualify for the exclusion. This tool will not translate FTB applications, such as MyFTB, or tax forms and other files that are not in HTML format. Some publications and tax form instructions are available in HTML format and can be translated. Visit our Forms and Publications search tool for a list of tax forms, instructions, and publications, and their available formats. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide.

Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years. Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing. Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards. In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee.

When you sell your asset for less than your adjusted basis, the IRS considers that a capital loss. The following table includes types of assets and their respective capital gains tax rates. As a homeowner, you’ll have to pay taxes related to your property from the time you buy the house all the way through the home sale.

Unused capital losses can be carried forward to future tax years. The nature of the property transfer can dictate when capital gains tax is due as well. If you inherit a house from a family member, for instance, you wouldn’t be required to pay this tax, even if the market value had increased significantly since it was originally purchased. In fact, the property’s cost basis would “step up” to reflect the current value. So, if you sell the house later on, you would use that updated basis instead of the original value.

Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation. The law requires you to keep and maintain records that identify the basis of all capital assets. If you own securities, including stocks, and they become totally worthless, you have a capital loss but not a deduction for bad debt.

No comments:

Post a Comment