Table Of Content

Like gains, capital losses come in short-term and long-term varieties and must first be used to offset capital gains of the same type. Accumulated appreciation means owners may need to anticipate a capital gains tax bill when they eventually sell. Growth in the value of property means owners make more at the sell, but could possibly owe more, as well. You have indicated that you received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. You must report all 1099-B transactions on Schedule D (Form 1040), Capital Gains and Losses and you may need to use Form 8949, Sales and Other Dispositions of Capital Assets.

Purchase Gift

Homeowners can avoid paying taxes on the sale of a home by reinvesting the proceeds from the sale into a similar property through a 1031 exchange. This like-kind exchange—named after Internal Revenue Code Section 1031—allows for the exchange of like property with no other consideration or like property including other considerations, such as cash. The 1031 exchange allows for the tax on the gain from the sale of a property to be deferred, rather than eliminated. In the weeks-long row over her former living arrangements, Rayner has repeatedly faced questions about whether capital gains was correctly applied to the sale of her property. As the discussion unfolds, it’s crucial for investors, business owners, and the public to stay informed and understand how these changes might affect them.

Home sale exclusion exceptions

You have a disposition when your home is destroyed or condemned and you receive other property or money in payment, such as insurance or a condemnation award. This is treated as a sale and you may be able to exclude all or part of any gain that you have. Certain events during your ownership, such as use of your home for business purposes or your making improvements to it, can affect your gain or loss.

What about a partial home exclusion?

In addition, you do not need to report the sale of the business or rental part on Form 4797. This is true whether or not you were entitled to claim any depreciation. However, you cannot exclude the part of any gain equal to any depreciation allowed or allowable after May 6, 1997, which must be recaptured and reported as ordinary income under section 1250(b)(3). Other examples of space within the living area include a rented spare bedroom and attic space used as a home office. Special rules for capital gains invested in Qualified Opportunity Funds.

One of the taxes you’ll consider when selling your home is the capital gains tax. The cost basis of your home typically includes what you paid to purchase it, as well as the improvements you've made over the years. When your cost basis is higher, your exposure to the capital gains tax may be lower. Remodels, expansions, new windows, landscaping, fences, new driveways, air conditioning installs — they’re all examples of things that might cut your capital gains tax. If you receive an informational income-reporting document such as Form 1099-S, Proceeds From Real Estate Transactions, you must report the sale of the home even if the gain from the sale is excludable. Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income.

Creating More Strategic Relevance for the Investment Banking Sector

While its rates are typically lower than ordinary income tax rates, the capital gains tax can still add up, especially on profits for big-ticket items like a home — the largest single asset many people will ever own. The capital gains tax on real estate directly ties into your property’s value and any increases in its value. If your home substantially appreciated after you bought it, and you realized that appreciation when you sold it, you could have a sizable, taxable gain. Let’s say you bought your home for $150,000 and you sold it for $200,000. Your profit, $50,000 (the difference between the two prices), is your capital gain – and it may be subject to the tax.

Mahendra Singh Dhoni: Captain Cool Meets his Younger Self to Pass on Business Tips

However, this is no longer the case, and the proceeds of the sale can be used in any way that the seller sees fit. The budget unveiled on April 16 included an increase in the capital gains tax for people who make more than $250,000 in profit on the sale of an asset. There are certain exemptions that you may use to avoid paying capital gains tax. For more information on how to avoid these capital gains taxes, please read How to Avoid Paying Capital Gains When You Sell Your Home. For investment properties, a 1031 exchange allows you to defer capital gains tax by reinvesting the proceeds from the sale into another investment property.

Put simply, you can prove that you spent enough time in one home that it qualifies as your principal residence. According to the Housing Assistance Tax Act of 2008, a rental property converted to a primary residence can only have the capital gains exclusion during the term when the property was used as a principal residence. The capital gains are allocated to the entire period of ownership.

These changes in eating habits can be a warning sign of dementia and Alzheimer's disease, experts say

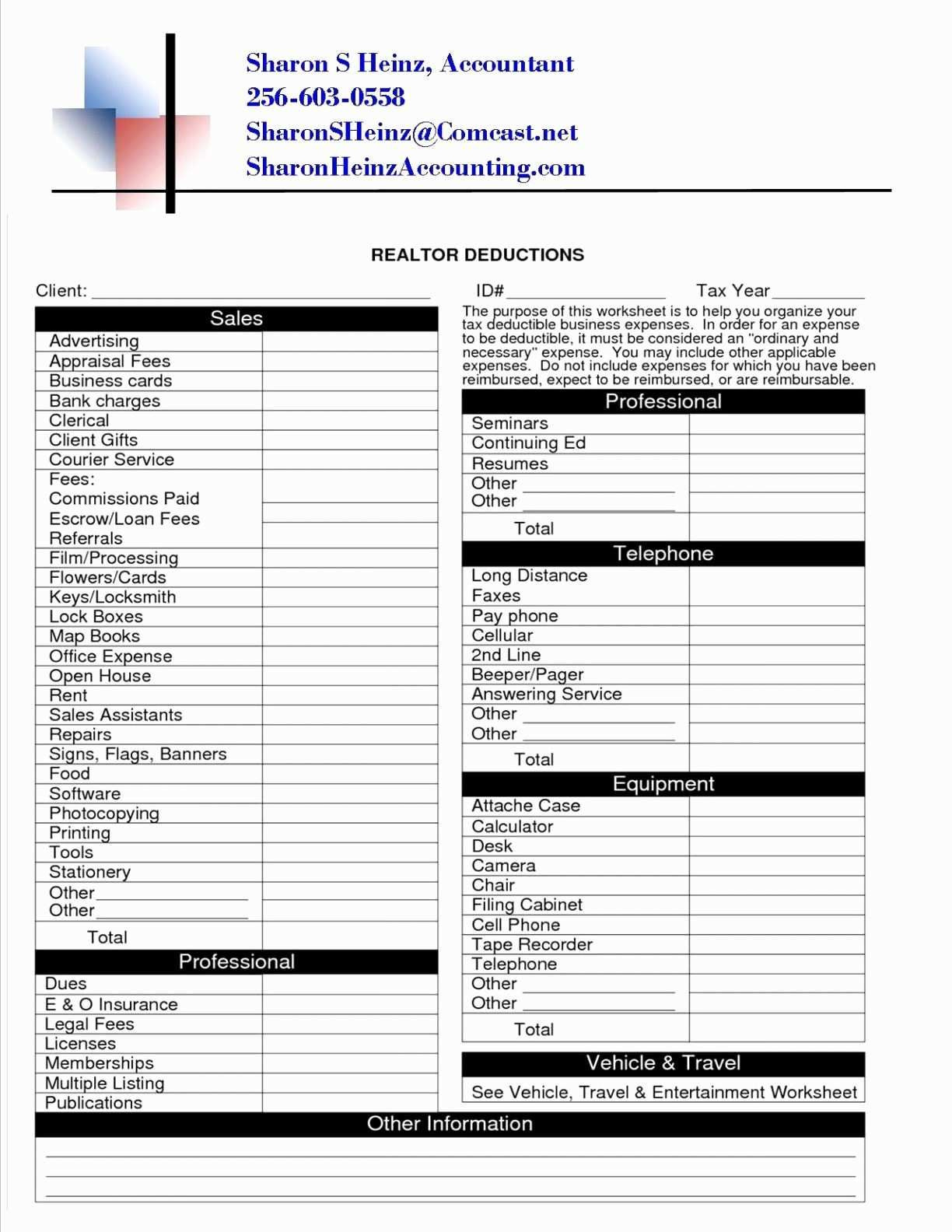

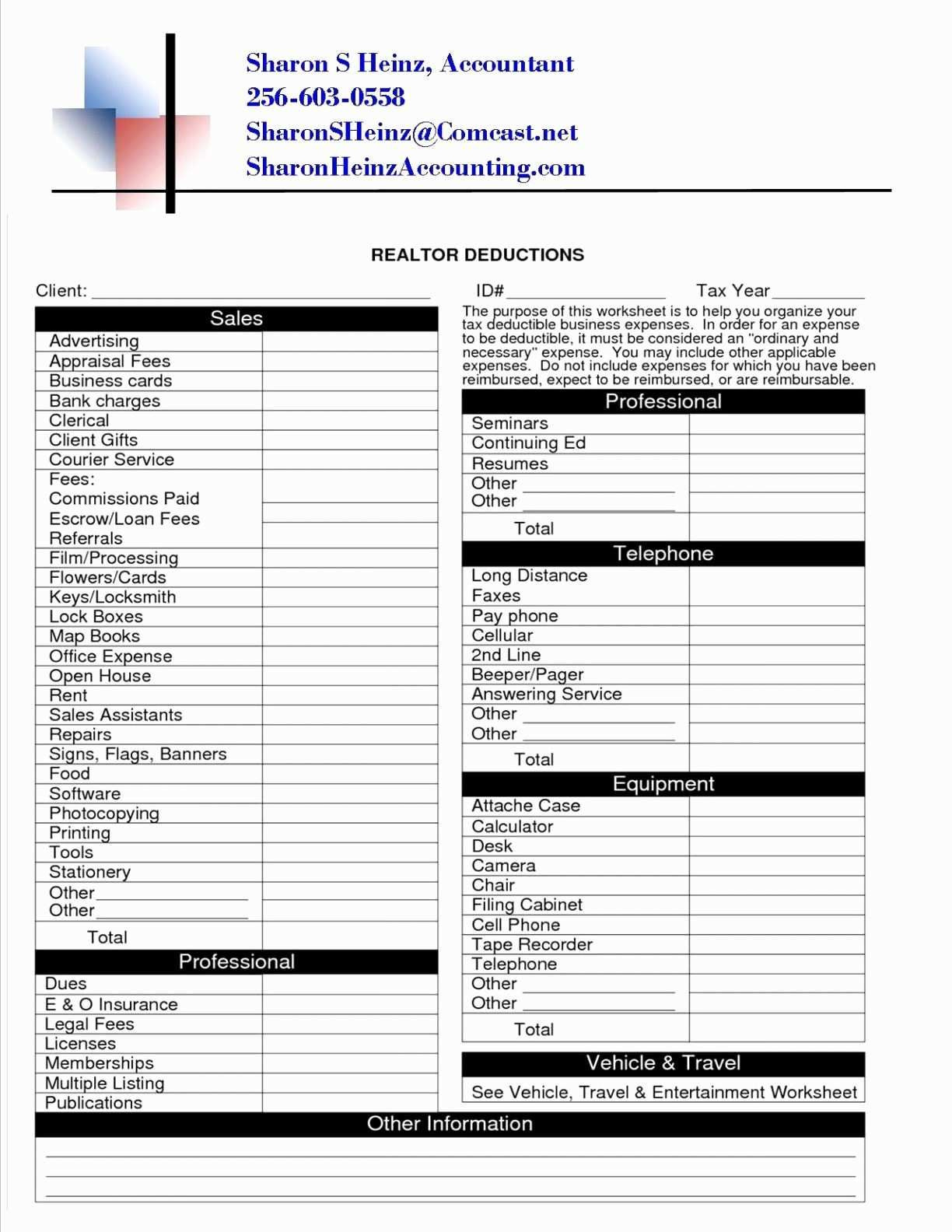

The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. Report on Schedule A (Form 1040), Itemized Deductions, any itemized real estate deduction. This section also covers special circumstances that apply to some home sellers. Generally, your home sale qualifies for the maximum exclusion, if all of the following conditions are true. Use this worksheet only if no automatic disqualifications apply, and take all exceptions into account.

The Qualified Opportunity Zone program was created under former President Trump’s 2017 tax reform law the Tax Cuts and Jobs Act (TCJA). Keep in mind that there are exceptions for property that’s gifted or inherited. Review Publication 544 from the Internal Revenue Service (IRS) for more information about these exceptions. Margo Winton Parodi is a freelance copyeditor who has worked on a wide range of subjects, from cookbooks to young adult novels to personal finance. She received her BA in Communications from UC San Diego in 2010 and her Copyediting Certificate from UC Berkeley Extension in 2015. She's been contributing to The Ascent since the spring of 2019.

You can now upload responses to all notices and letters using the Document Upload Tool. For notices that require additional action, taxpayers will be redirected appropriately on IRS.gov to take further action. The IRS uses the latest encryption technology to ensure that the electronic payments you make online, by phone, or from a mobile device using the IRS2Go app are safe and secure. Paying electronically is quick, easy, and faster than mailing in a check or money order. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals.

However, thanks to the Taxpayer Relief Act of 1997, most homeowners are exempt from needing to pay it. This example uses the current capital gains inclusion rate that requires half of the capital gains to be taxed. If you sold an asset for $500,000, with a purchase price of $100,000, your capital gain is $400,000 and the taxable capital gain is $200,000. The change will apply to those with more than $250,000 in capital gains in a year as of June 25. All corporations and trusts will also have to pay taxes on a bigger portion of their gains.

Income Tax: Selling jewellery to buy a house? You can claim exemption on capital gains Mint - Mint

Income Tax: Selling jewellery to buy a house? You can claim exemption on capital gains Mint.

Posted: Sun, 28 Apr 2024 03:46:56 GMT [source]

For corporations and trusts, all capital gains regardless of amount will be taxed at the two-thirds inclusion rate. If you did receive any federal mortgage subsidies, you must file Form 8828 with your tax return whether you sold your home at a loss or a gain. However, if you had a written agreement for the forgiveness of the debt in place before January 1, 2026, then you might be able to exclude the forgiven amount from your income.

Cottage listings to rise as owners try to sell before capital gains tax changes kick in, realtors say - Toronto Star

Cottage listings to rise as owners try to sell before capital gains tax changes kick in, realtors say.

Posted: Wed, 24 Apr 2024 09:00:00 GMT [source]

When calculating the holding period—or the amount of time you owned the asset before you sold it—you should count the day you sold the asset but not the day you bought it. For example, if you bought an asset on February 1, 2023, your holding period started on February 2, 2023, the one-year mark of ownership would occur on February 1, 2024. Capital gains tax is one of the most overlooked expenses you’ll need to pay on a real estate transaction. Read on to learn how you can prepare when it's time to sell your home. The information herein is general and educational in nature and should not be considered legal or tax advice.

No comments:

Post a Comment